Corporate Tax Increase 2025. White house officials said the new proposal would cover all employees paid more than $1 million, and raise more than $250 billion in new corporate tax revenue over 10 years. President biden proposes raising the current corporate tax from 21% to 28% and preventing companies from now paying little to no tax in the u.s.

White house officials said the new proposal would cover all employees paid more than $1 million, and raise more than $250 billion in new corporate tax revenue over 10 years. Elimination of tax breaks for fossil fuel energy companies would raise $45.1 billion in new revenues over the decade through 2034, while raising the overall corporate tax rate to.

Landen met de hoogste en laagste vennootschapsbelastingtarieven in, The government has today, friday 14 october, announced that corporation tax will increase to 25% from april 2025 as already legislated for, raising around £18 billion a. Updated mon, mar 27, 2025, 11:36 am 3 min read.

Chart Global Corporation Tax Levels In Perspective Statista, The corporate tax 2025 guide provides the latest legal information on types of business entities, special incentives, consolidated tax grouping, individual and corporate tax rates,. President biden proposes raising the current corporate tax from 21% to 28% and preventing companies from now paying little to no tax in the u.s.

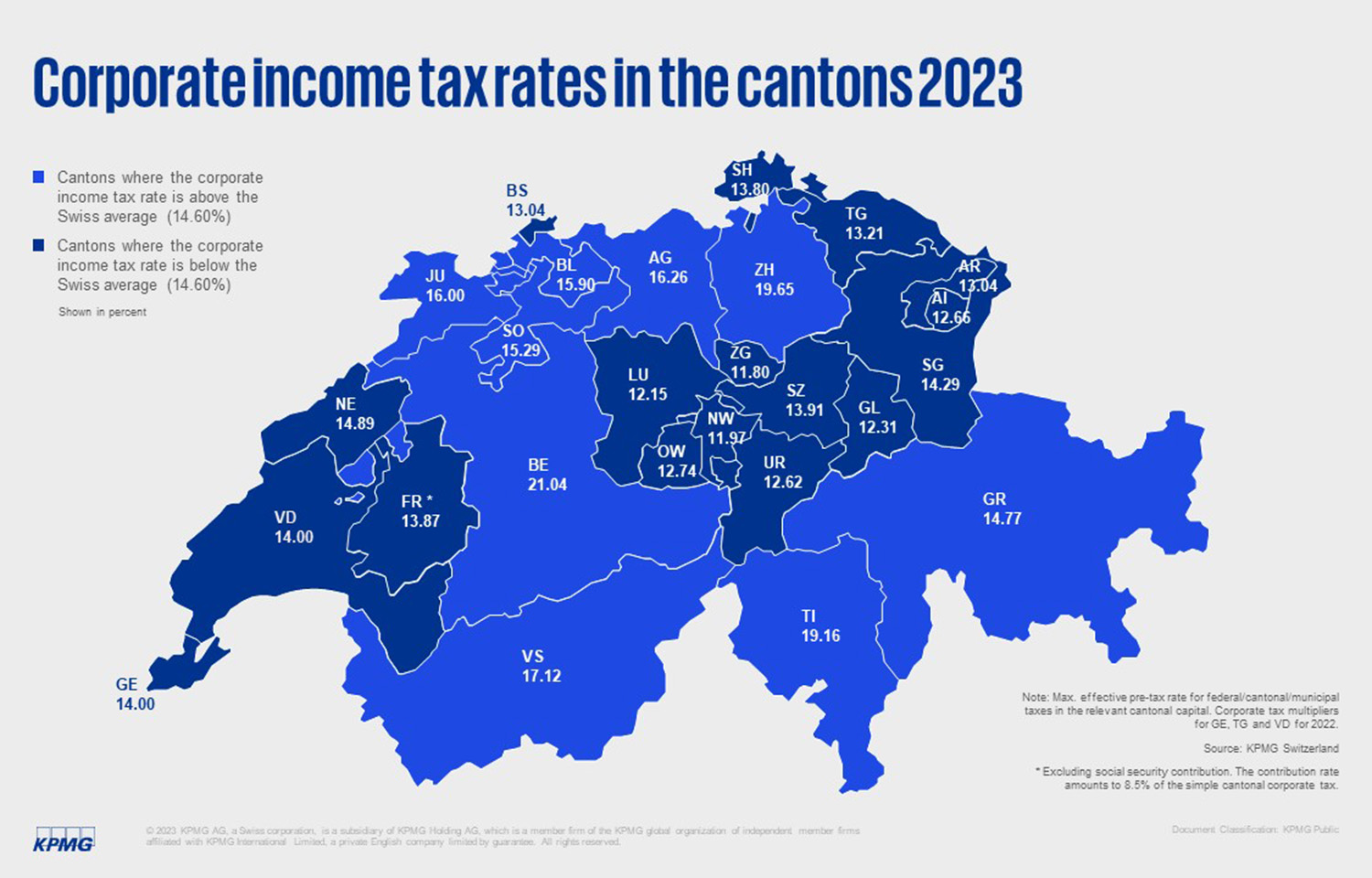

Media press release Clarity on Swiss Taxes 2025 KPMG Switzerland, Small profits rate (companies with profits under £50,000) 19 %: Updated mon, mar 27, 2025, 11:36 am 3 min read.

State Corporate Taxes Increase Tax Burden on Corporate Profits, Notable state corporate income tax changes for 2025. Following news in october 2025 that the corporation tax rate will increase to 25% from 1 april 2025, the tax faculty has updated this article to reflect the confirmed increase in.

Biden Corporate Tax Increase Details & Analysis Tax Foundation, It will go up from 19% to 25% for companies with over. New corporate alternative minimum tax.

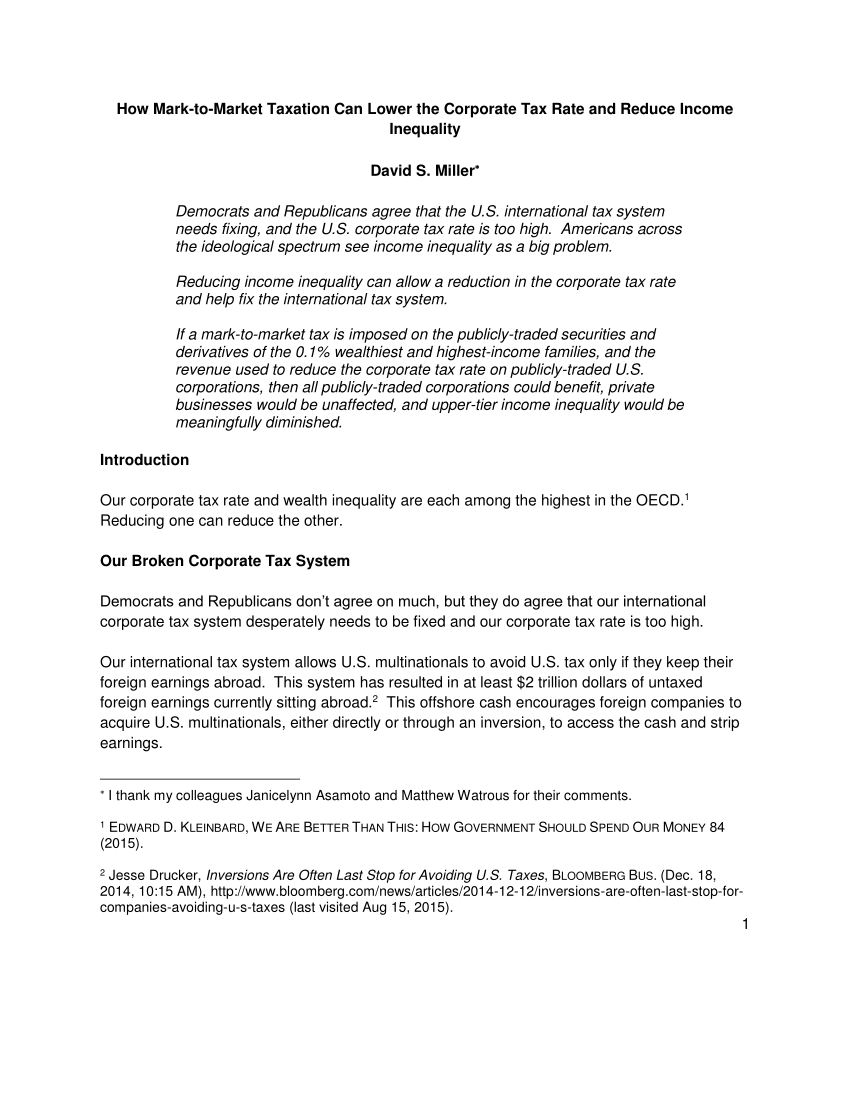

(PDF) How MarktoMarket Taxation Can Lower the Corporate Tax Rate and, 19% — — — — — — main rate (companies with profits over. Following news in october 2025 that the corporation tax rate will increase to 25% from 1 april 2025, the tax faculty has updated this article to reflect the confirmed increase in.

Indonesian Corporate Tax Introduction and Guide of Indonesian, Boost the corporate tax rate from. 2025 2025 2025 2025 2025 2019 2018 2017;

Gov. Walz’s corporate tax hike would give MN highest starting, 19% — — — — — — main rate (companies with profits over. In 2025, austria reduced its corporate income tax rate, finalizing a 2025 scheduled tax cut.

Fed Anticipates End of Era for Stocks Amid Slowing Corporate Profit, Following news in october 2025 that the corporation tax rate will increase to 25% from 1 april 2025, the tax faculty has updated this article to reflect the confirmed increase in. Nevertheless, of all european countries, only turkey and the united kingdom increased.

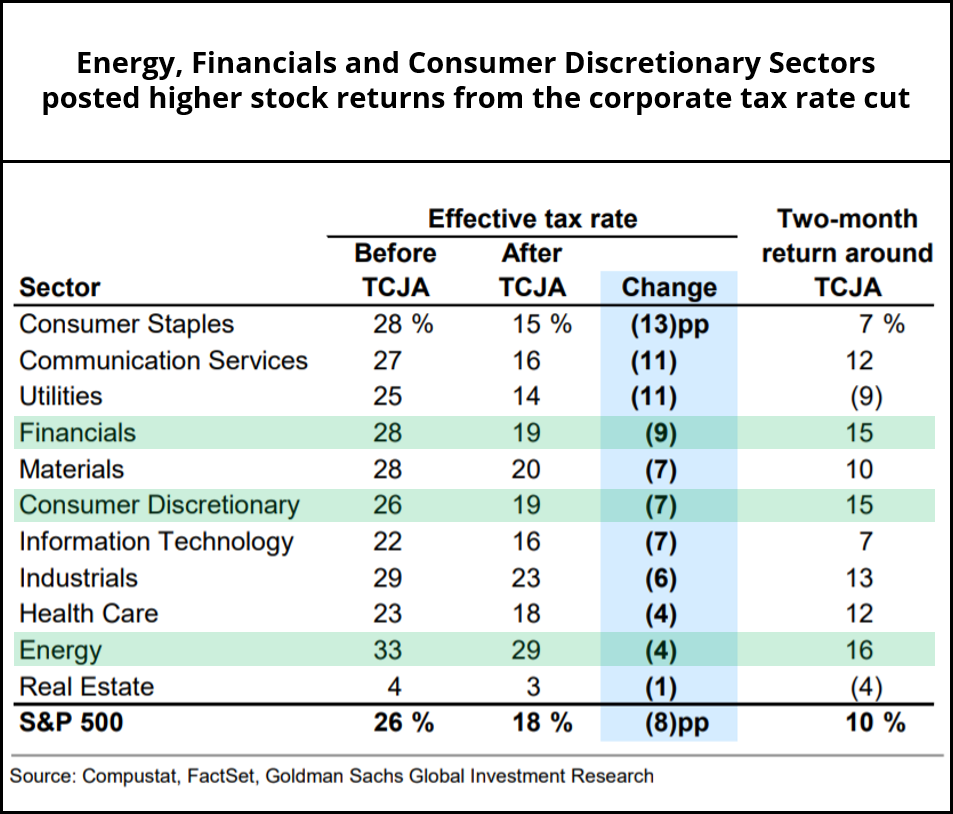

US Corporate Tax Hike after the election? Most negatively impacted, It will go up from 19% to 25% for companies with over. For periods before april 2025,.